President Biden shapes our nation’s fiscal policy, and Federal Reserve Chairman Jerome Powell directs the monetary policy. But, these two social engineers seem clueless about what is happening to Americans on Main Street, behaving more like Tweedledum and Tweedledee. Their vacuous remarks about the economy are often chilling. Americans shudder to think that their economic future is in the hands of these two leaders.

One stark example of the consequences of their policies is the fading American dream of home ownership. The dream that once symbolized prosperity and stability is now slipping away under the weight of their economic policies.

Beyond his reputation for cunning lawfare and weak foreign policy, President Biden is the mastermind behind Bidenomics, his signature economic policy. His legislation, like the Inflation Reduction Act, has had far-reaching effects. His reckless spending and his green energy policies have transformed the U.S. from an energy-independent nation to one dependent on others. The result? 'Bidenflation' (the rise in prices under his watch) hovers around 18%.

In the lead-up to the election, President Biden takes on the role of Santa Claus, promising gifts like $160 billion in student loan waivers to win over young voters. He even goes against recent Supreme Court rulings to do so. Biden also tries to shift the blame for 'Bidenflation' onto Trump despite sounding out of touch with reality. He even dares to predict the Federal Reserve's monetary policy, disregarding the Fed's independence. In a White House press conference during Japanese Prime Minister Fumio Kishida’s visit, he boldly stated, “Well, I do stand by my prediction that, before the year is out, there’ll be a rate cut.”

On the other hand, Chairman Powell has a history of swinging quickly between hawkish and dovish monetary policy positions.

At the FOMC post-meeting conference on Wednesday, Chairman Powell sounded witty and laughed at the idea of stagflation. Powell said:

I was around for stagflation, and it was 10% unemployment, high-single-digit inflation, and very slow growth. Right now, we have 3% growth, which is pretty solid growth, I would say, by any measure. And we have inflation running under 3% … I don’t see the ‘stag’ or the ‘flation,’ actually.

Powell was reminiscing about the stagflationary economy of the 1970s and early 1980s. Watching the nation’s monetary policy chief make a clueless and flippant remark was jaw-dropping.

Powell was exaggerating, reflecting his wishful thinking. Neither do we have 3% growth nor inflation running under 3%.

Was he pleasing President Biden in an election year? What made him transform from his hawkish posture two weeks before to take a dovish stance? Or must we chalk this one in the same category as the notion of "transitory" inflation he tried to sell a few years ago?

There are many signs of a slowing economy. All you need to do is look. Here’s the Stag part of it.

In the first quarter, the U.S. economy grew at its slowest pace in nearly two years. The Commerce Department's recent report revealed that GDP expanded by only 1.6% in the first quarter, ending a six-quarter streak of 2% or higher growth.

On Wednesday, the Institute for Supply Management reported that a decline in orders led to a contraction in U.S. manufacturing in April, reversing a brief expansion in the previous month. Additionally, prices paid by factories for raw materials approached a two-year high during this period.

American consumers are pessimistic, as indicated by the RealClearMarkets/TIPP Economic Optimism Index, a leading gauge of consumer sentiment. Further, reports show that consumers are pulling back, impacting sales this quarter at Starbucks, KFC, and McDonald’s.

Some business leaders are noticing the signs Chairman Powell refuses to acknowledge. Last week, speaking at the Economic Club of New York, JPMorgan CEO Jamie Dimon said that now more than ever, the economy resembles the 1970s, when both inflation and unemployment were high, but economic growth was weak.

Next, consider the "flation" aspect of stagflation.

Put simply, Americans find themselves squeezed by inflation. Since January 2021, prices have increased by 18.8%, while real wages have declined by 2.5%. According to some estimates, Americans need an extra $12,828 yearly to make ends meet.

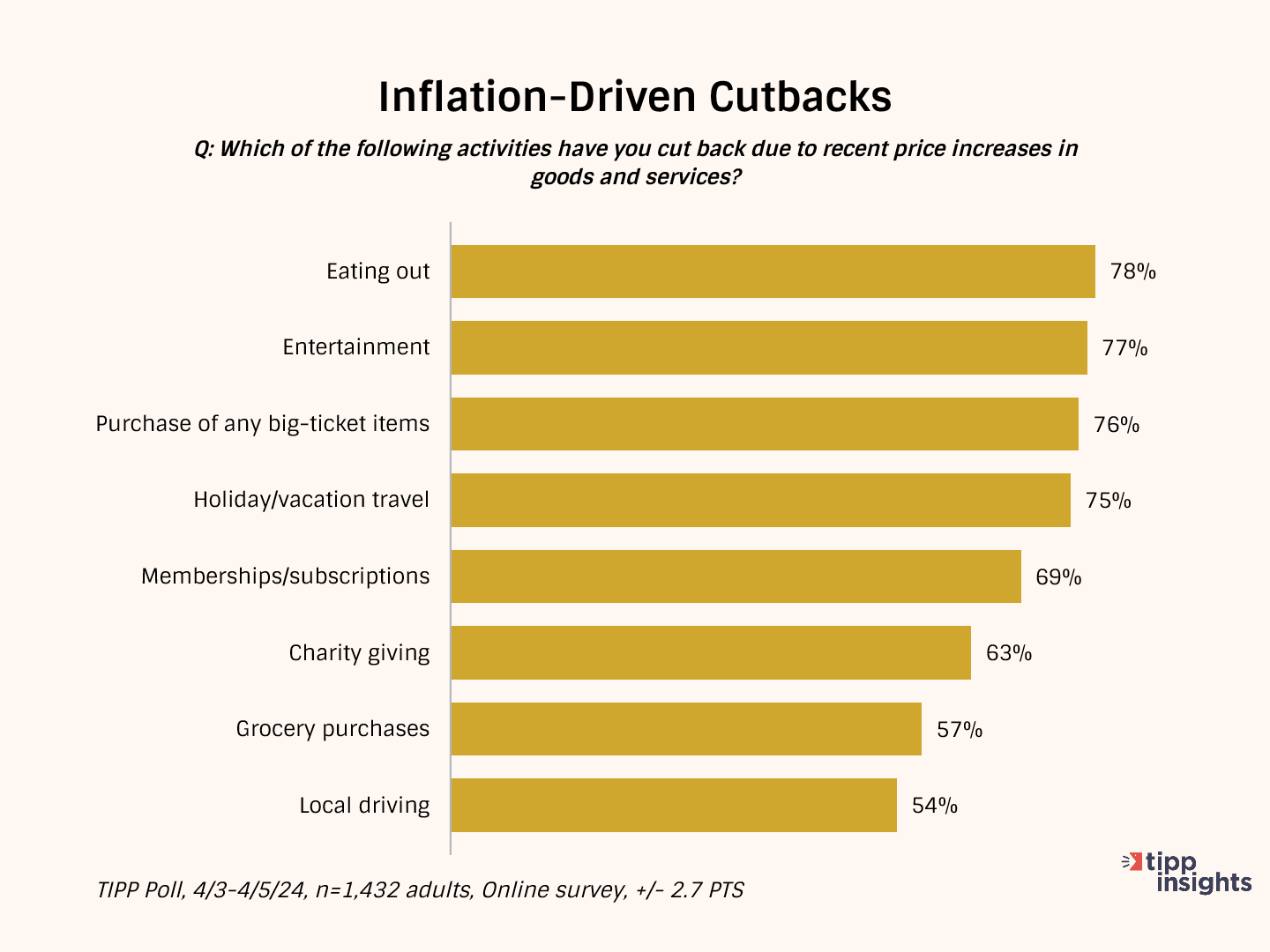

Based on our research findings, we recently published an editorial on Americans' financial well-being, titled 21 Charts Reveal Bidenflation's unyielding grip on Americans. The article shows that the pain of inflation has not lessened for Americans because their wages are not growing. They struggle to pay their mortgage, utility bills, auto loans, credit card payments, school fees, and daily expenses to maintain their living standards.

Chairman Powell and the Fed subscribe to copious research about Americans’ financial well-being. Oddly, he still lacks sensitivity to Americans’ predicaments, and his talk borders on insult.

Both Biden and Powell share the trait of engaging in loose talk that is far from reality. Sadly, their decisions dictate our economic destiny.