It is believed and proffered that in America, the land of opportunities, those willing to work hard will realize their dreams of a prosperous tomorrow. However, with the current state of the economy, it is prudent to ask if some components of the American Dream are becoming unattainable for many Americans.

Many Americans look forward to buying a home as a milestone in their lives. The sense of accomplishment, security, and stability contribute significantly to one's emotional well-being and foster a deeper sense of community.

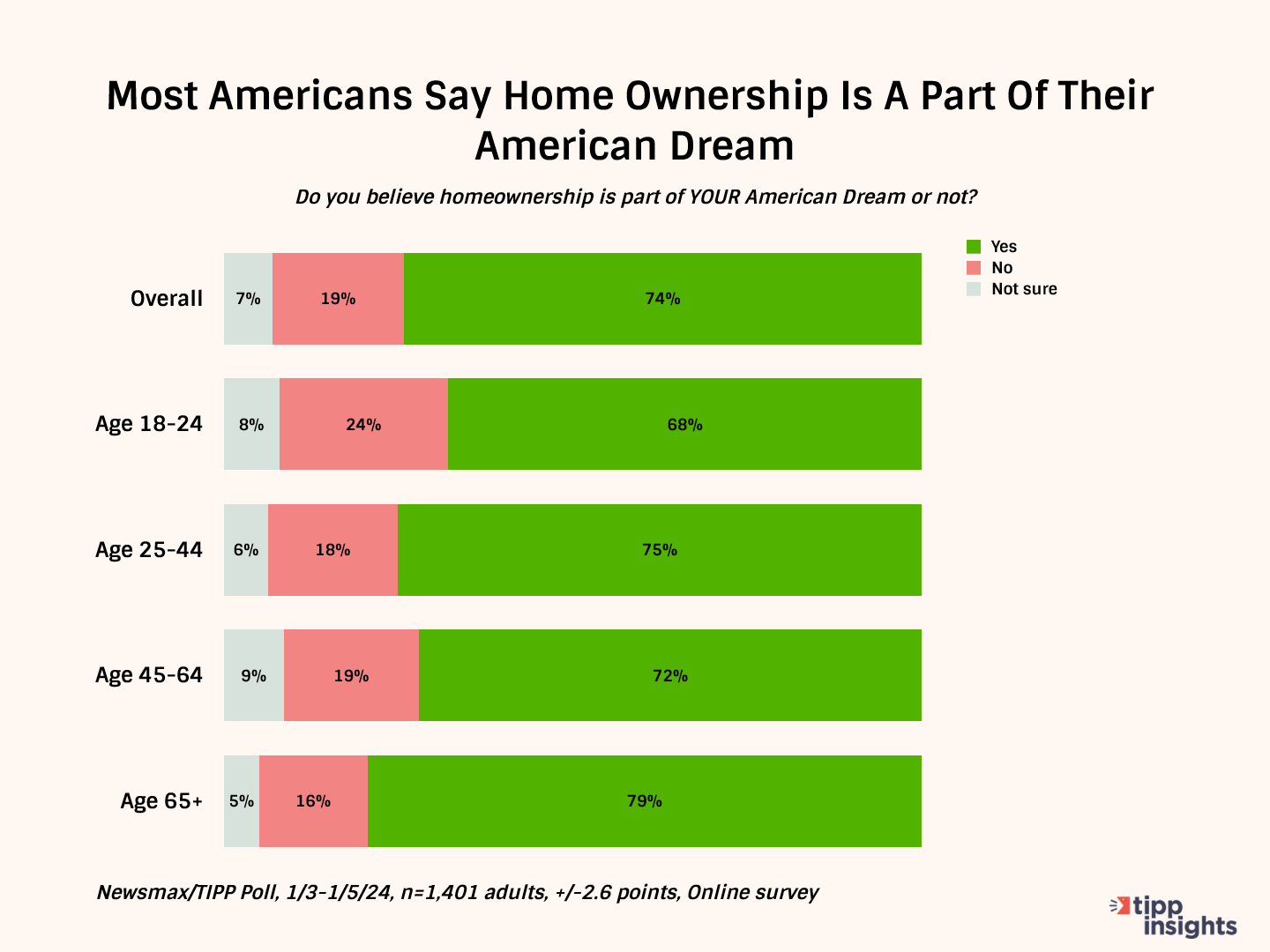

A recent Newsmax/TIPP Poll found that for three-quarters, 74%, of the people who took part in the survey, owning a home is part of their American Dream. Age and other criteria seem to have little sway over the desire to have a place called one’s own.

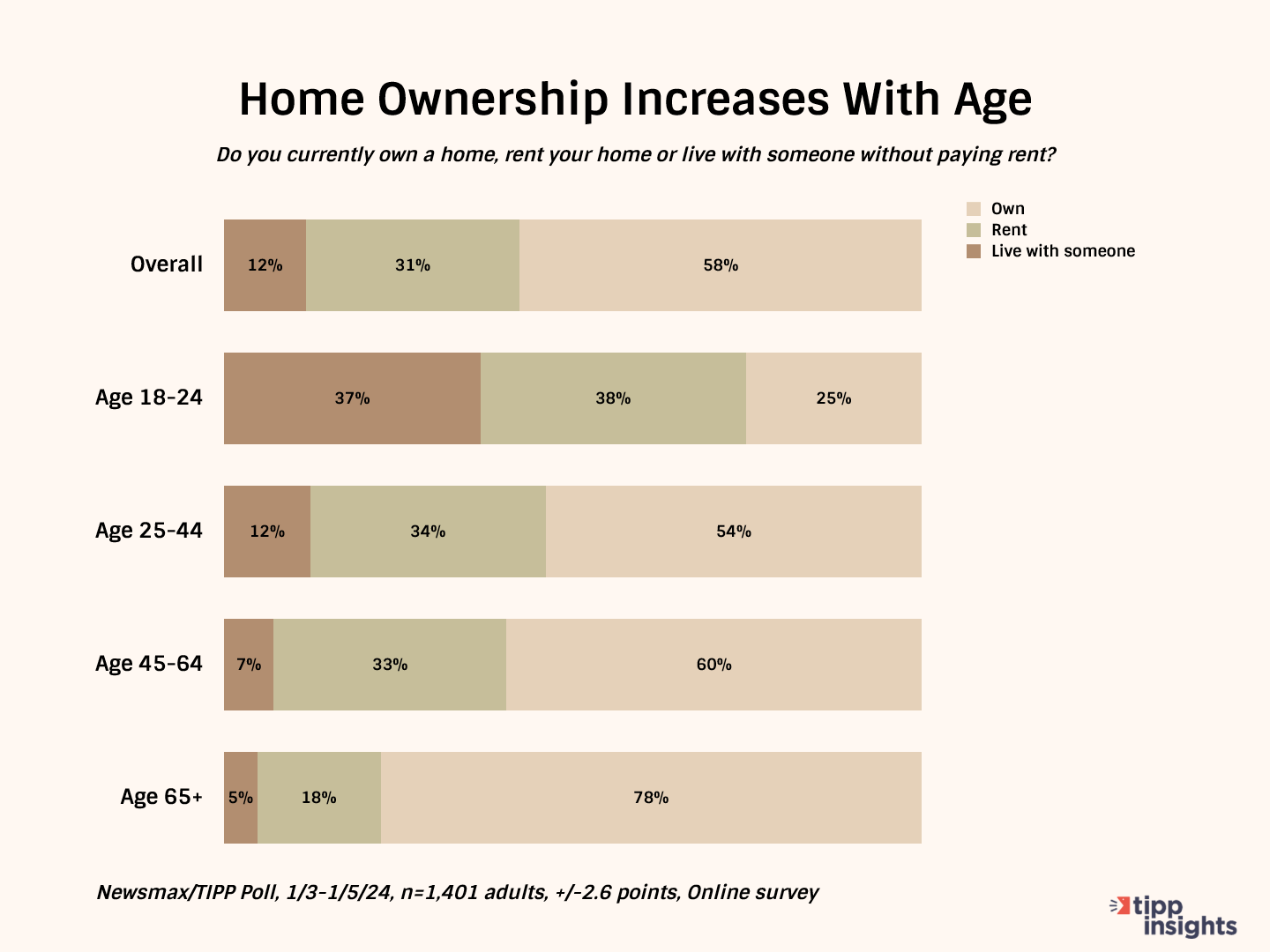

While the dream and desire may be widely prevalent, the reality is that of the 1401 survey respondents nationwide, only 58% own a home. Almost a third, 31%, live in rented accommodations, and another 12% currently live with family or have a roommate.

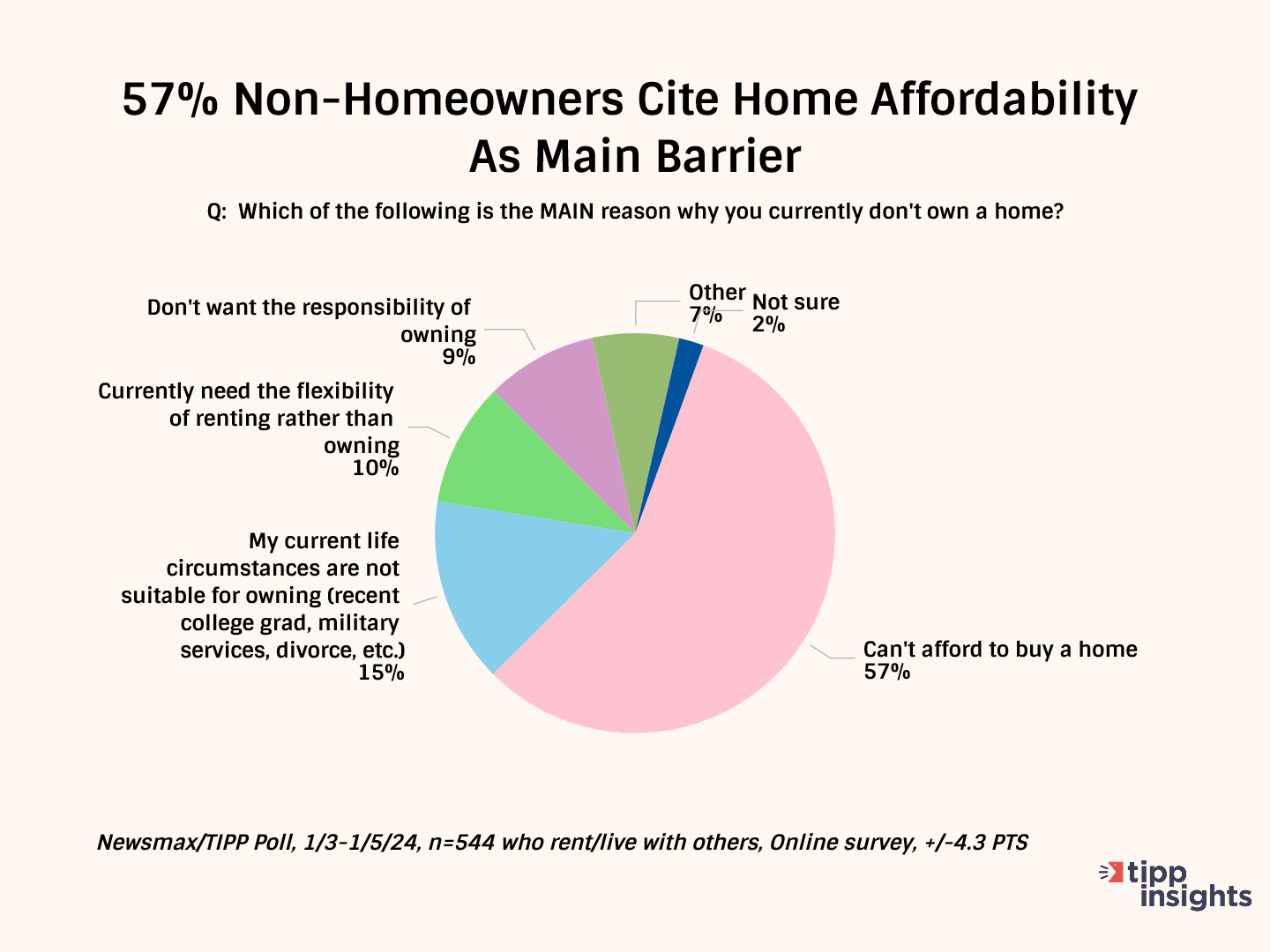

Buying a home is a big decision and one that is influenced by many factors. While there were many reasons for the significant percentage not owning a house, a clear majority, 57%, said they could not afford a home despite their wish to do so. Current life situations like military service, divorce, etc., kept another 15% from owning a residence. A tenth found renting to be more suitable to their life right now. Another tenth, or 9% to be exact, simply did not want the responsibility of owning a house.

A closer look at those already possessing a dwelling reveals that while 78% of seniors are homeowners, only 60% of the 45-64 age group own a home. The figure drops to 54% among the 25-44 year olds. The data points to the economy's trajectory over the past few decades. In the past, Americans bought starter homes at reasonable mortgage rates and moved to permanent homes when their financial status improved.

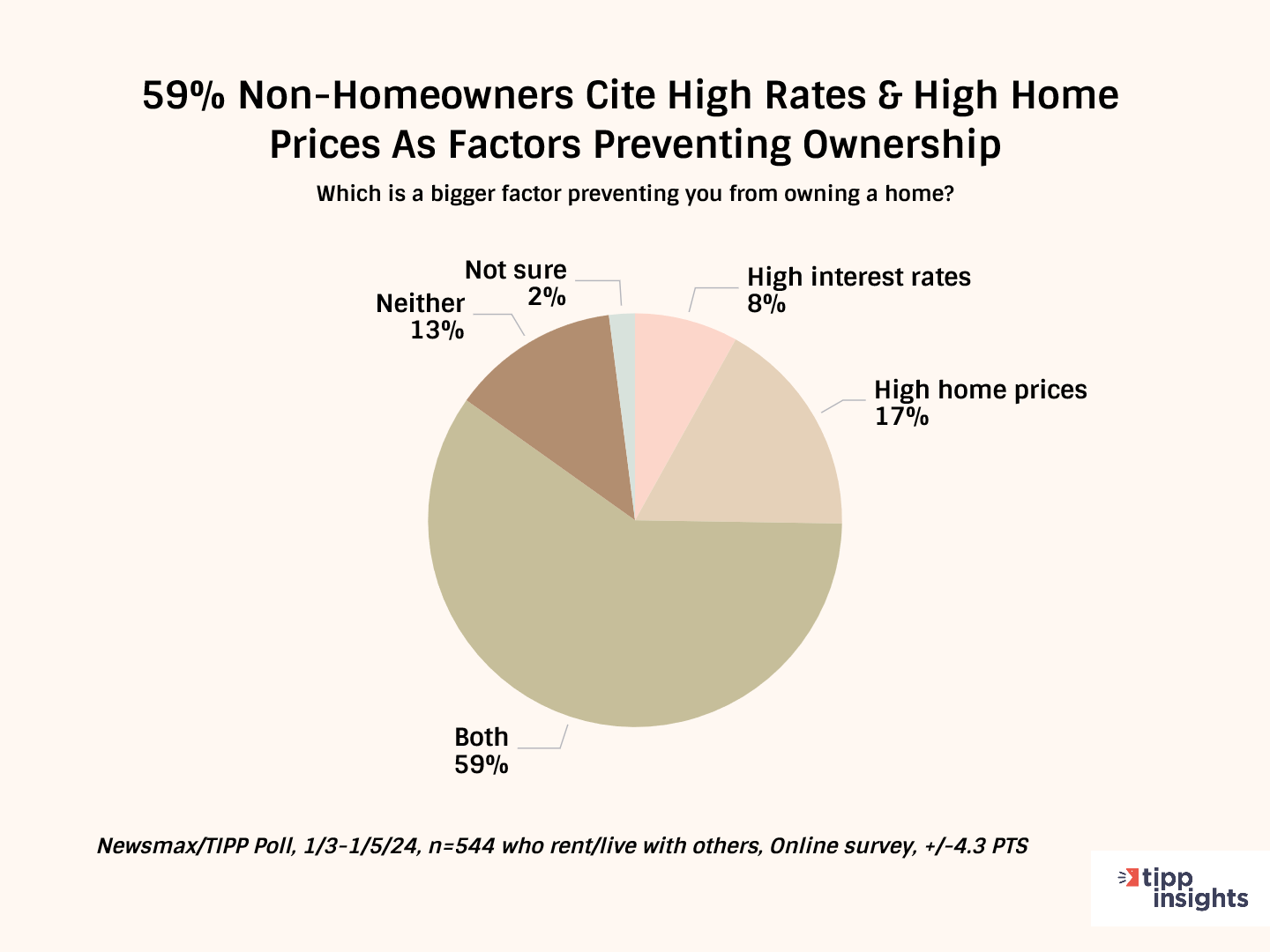

But, today’s market is not conducive to such initiatives. Prohibitive interest rates and high asking prices turn away those looking to buy a home. According to the National Association of Realtors index, in 2023, home-buying affordability fell to the lowest level since 1985.

With raging inflation and the Feds keeping interest rates high to rein in prices, mortgage rates have also skyrocketed. It is estimated that a media household must set aside more than 40% of its income to cover payments on a median-priced home. With wages barely and rarely keeping up with inflationary pressures, it is unsurprising that many cannot meet the down payment mandates stipulated by lending institutions.

High prices deterred 17%, and 8% were discouraged by the high-interest rates, while a majority, 59%, stated that the combined effect of high home prices and high-interest rates prevented them from purchasing a residence.

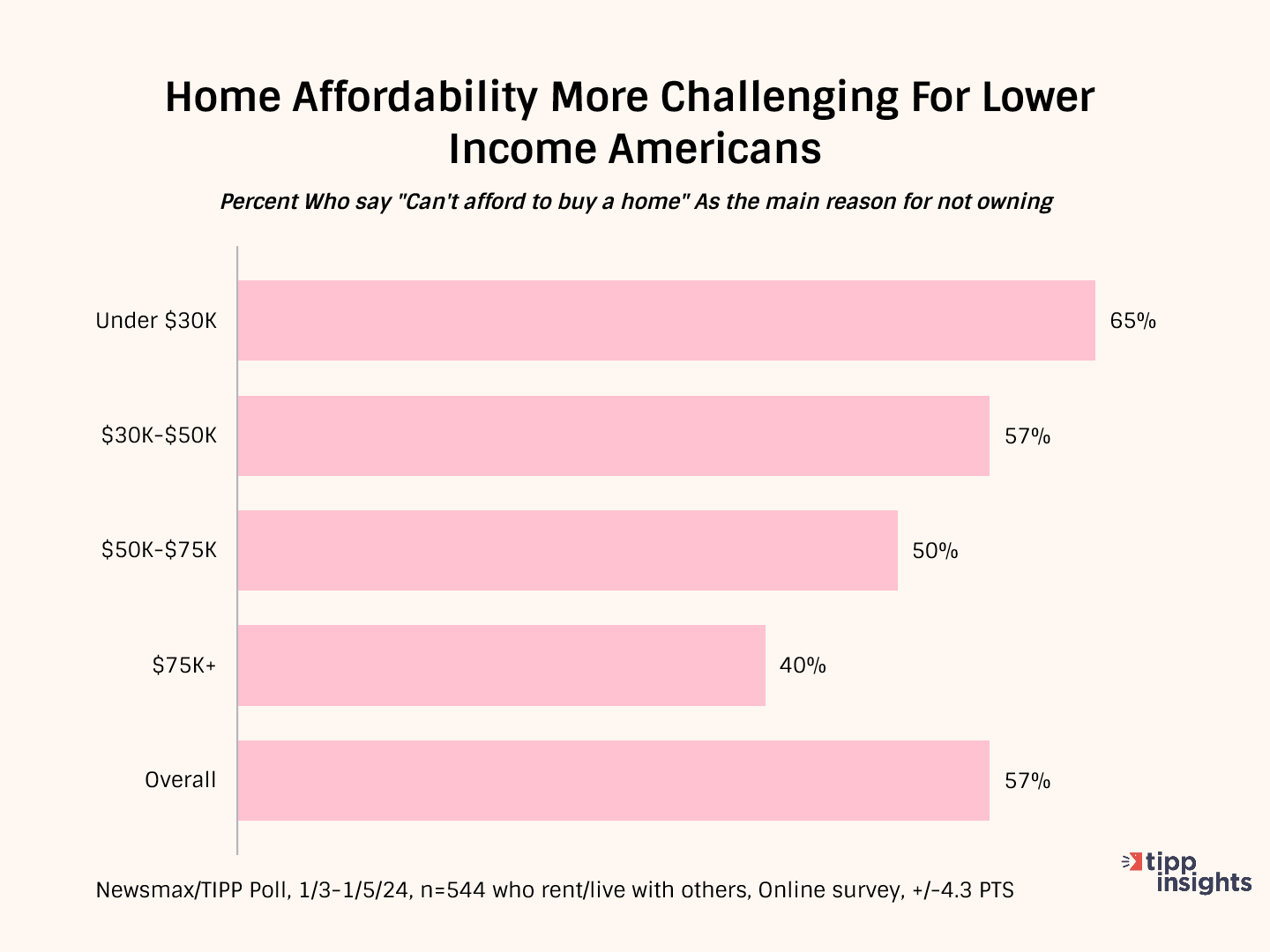

About two-thirds of those in the lowest income bracket (less than $30K) and more than half (57%) of those in the $30K-$50K income segments simply “cannot afford a home.” These numbers paint a sad picture, as many low-income families may never enjoy the stability and security of owning a home.

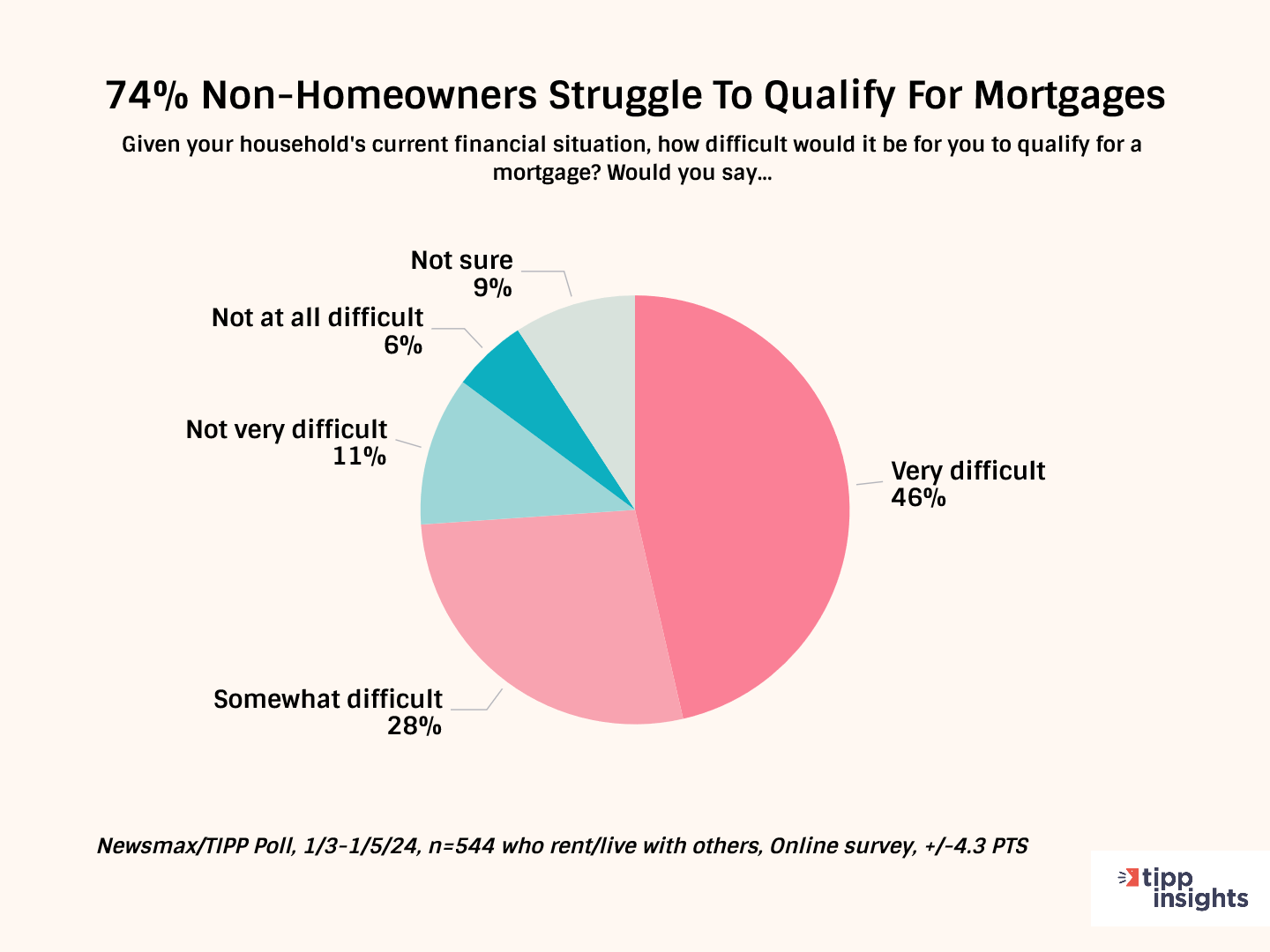

Three-fourths of non-homeowners in the survey said it would be difficult to qualify for a mortgage.

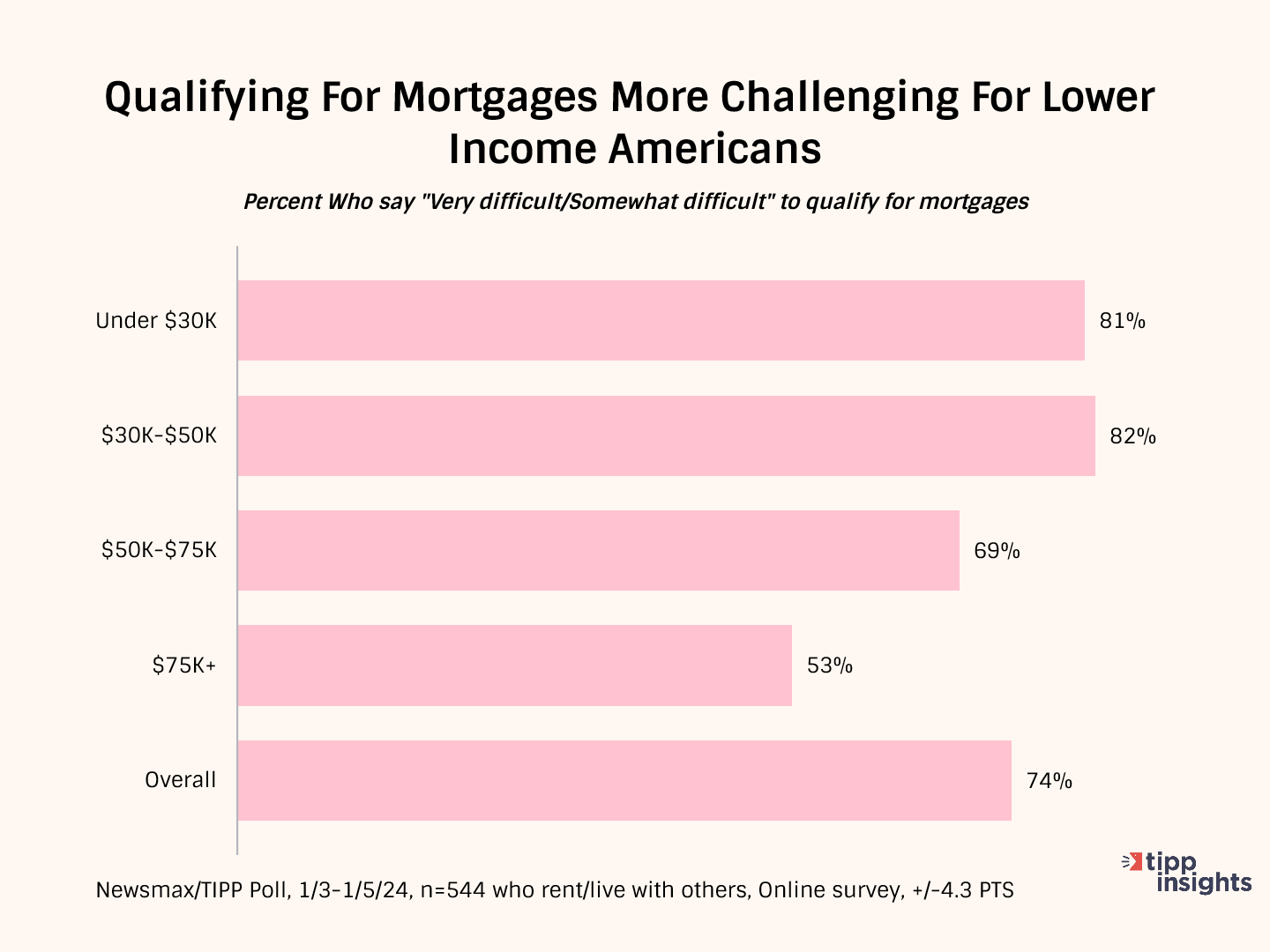

Further, the data shows qualifying for mortgages is more challenging for lower-income Americans.

The pre-pandemic setting, characterized by low-interest rates and a strong economy, encouraged Americans to buy homes and invest in property. However, now that the Feds have eased up on buying bonds backed by home mortgages, mortgage rates will likely remain high. Thanks to the short supply of available homes, prices will unlikely come down soon.

The grim scenario is widening the wealth gap in American society. The American residential real estate market was estimated to be worth around $2.53 trillion in 2023. Analysts opine that the sector will reach $2.80 trillion by 2028. While many may see this as a sign of a healthy economy, the sad reality is that Americans are struggling to attain their dream of owning a home.