Give President Trump credit for taking on the third rail in global commerce by single-handedly addressing tariffs between trading nations and the United States.

Ever since his "Liberation Day" announcement, when various nations appeared on a chart listing new tariffs, the markets and the media have not been kind to Trump. Righting a battleship and turning it around 180 degrees takes time and effort, but markets and the media have little patience. A few unforced errors, like the loud discordant voices within the administration, compounded the issue. When bond markets fell, bond yields increased, and Trump was forced to recalibrate his chart and even walk back a few tariffs.

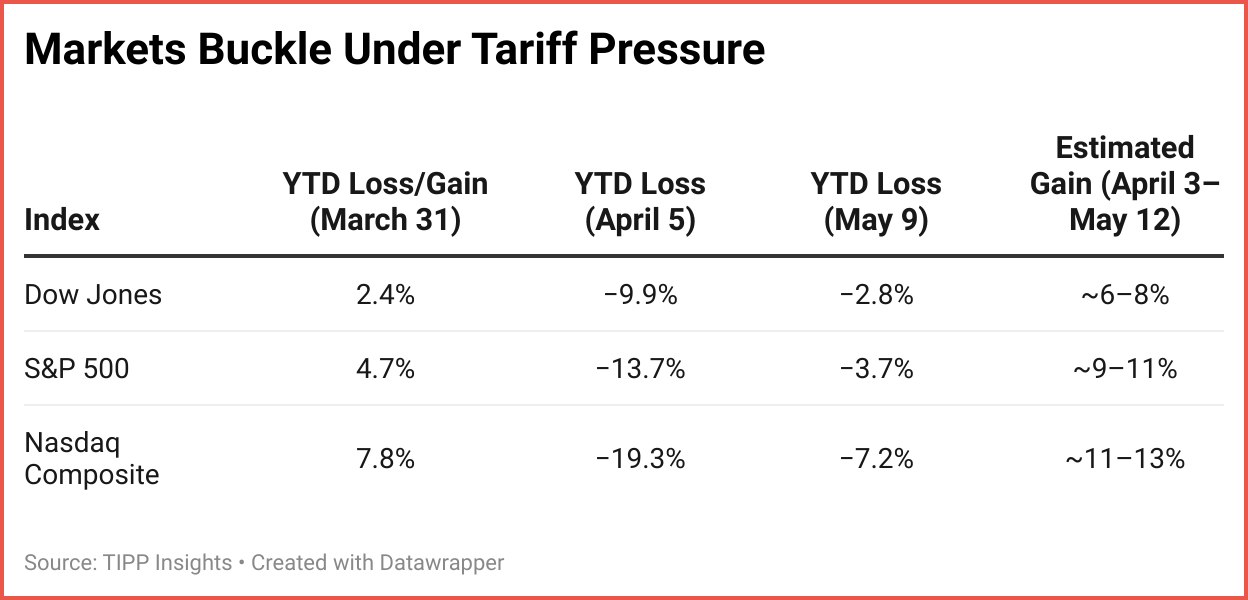

The chart below shows the seesaw impact on Wall Street indices. All indices were positive for the year before April 2 (Liberation Day). Immediately after the tariff announcement, all indices fell, some precipitously. After the broad agreements with the UK and China, markets have recovered significantly, although all indices are net negative compared to before Liberation Day. As more countries sign agreements and the details of China's tariffs become clearer, things could return to positive territory by the end of the second quarter. For a country that has experienced trade deficits for decades, a single quarter of up and down performances is not terrible, given the mostly positive structural changes that Trump has forced on the global economy.

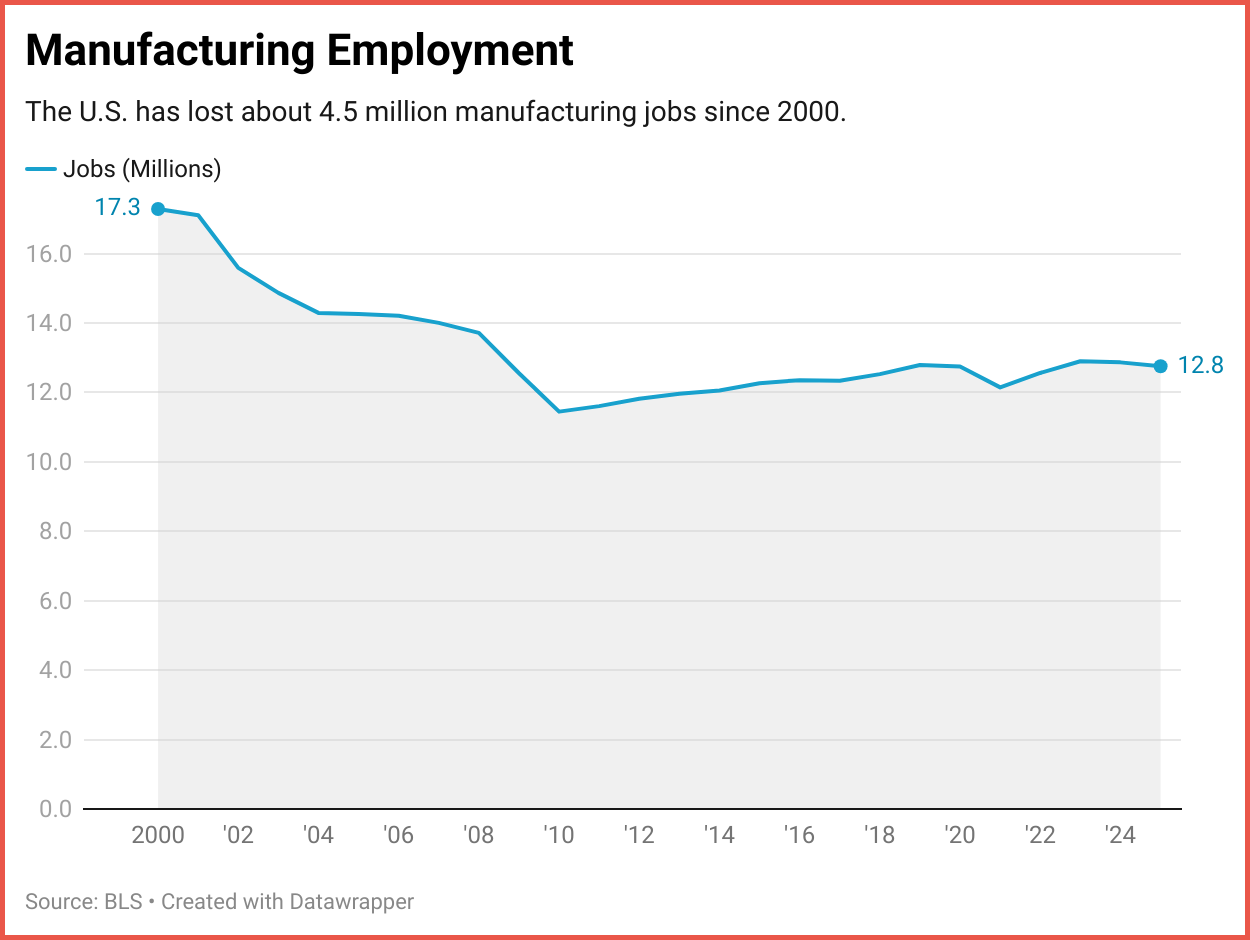

So, what have Trump's arguments been about using tariffs to benefit America? Boosting American manufacturing and jobs ranks at the top of his justifications, and even Trump's diehard critics will have no issues with this objective. By incentivizing foreign companies to locate their plants in America and pay no tariffs against the option of those companies paying tariffs when they export products to America, Trump is hoping that many companies would re-shore their operations.

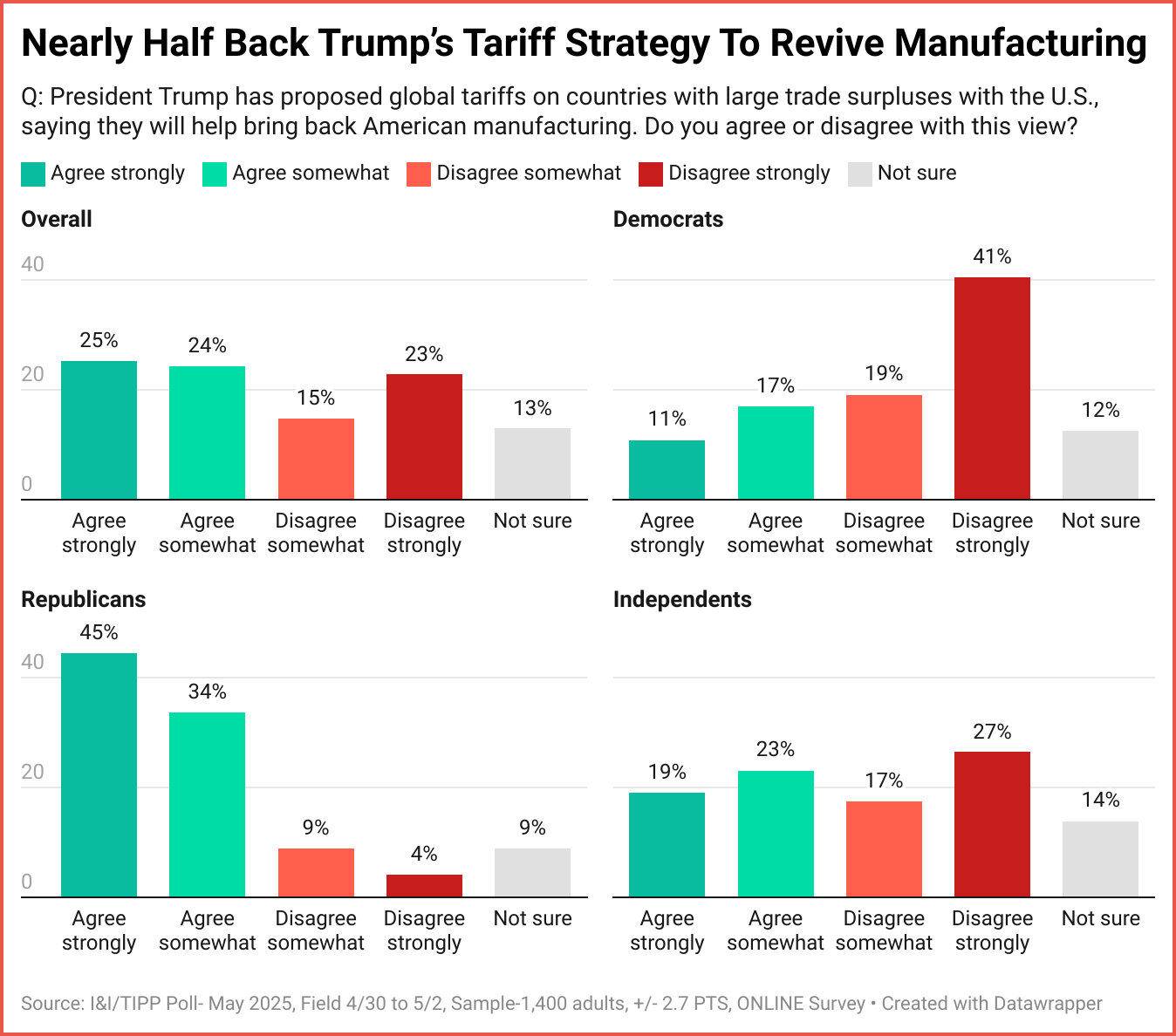

A recent I&I/TIPP Poll finds that nearly half of Americans support President Trump’s global tariff strategy aimed at reviving U.S. manufacturing. While Republicans overwhelmingly back the plan, Democrats lack enthusiasm, and independents remain split.

The U.S. has shed 4.5 million manufacturing jobs since 2000, highlighting the scale of the challenge Trump seeks to reverse.

Other laudable goals include reducing chronic trade deficits, raising federal revenue, reducing dependencies on foreign countries for critical elements of the supply chain, punishing unfair trade practices, and using America's buying power to extract strategic and geopolitical leverage.

However, the core goal has been to improve foreign investment in America so that more goods can be made in America and even exported to the rest of the world. Landing in Riyadh this week to a splendid welcome, Trump is bent on persuading the Kingdom of Saudi Arabia to invest up to $1 trillion in America. The White House is already fond of saying that it has received commitments of nearly $5 trillion in investments from various companies, countries, and sovereign wealth funds.

For America to regain its position as a manufacturing superpower, it needs several critical inputs: land, energy, labor, raw materials, capital/technology, transportation/logistics, water, regulatory frameworks, and information/data. These inputs must be cost-effective compared with the rest of the world, or American-manufactured products will cost more.

America has all of the critical inputs in abundance except one. The missing component is skilled labor. Administration officials have argued that most manufacturing today is robotics-driven, and the need for labor is not as dire. But even a highly automated factory environment cannot function efficiently if there aren't qualified technicians, engineers, and scientists to set up the assembly line and oversee the process.

Consider labor issues at Taiwan Semiconductor Manufacturing Company's (TSMC) advanced chip plant in Arizona, a $40 to $65 billion project backed by the U.S. CHIPS Act. TSMC is the foremost maker of advanced chips with multiple facilities in Taiwan, having honed its experience over decades.

In Arizona, TSMC ran into labor competition with Intel, America's leading chip maker, as Intel was trying to finalize its state-of-the-art fabrication facilities nearby. Intel had trouble recruiting qualified workers, as there was a severe shortage of skilled technicians experienced in advanced chip manufacturing. Worried about delays, TSMC planned to import 500–700 Taiwanese technicians to train U.S. workers and accelerate construction. However, this move immediately sparked a backlash from local unions. Cultural and language issues were a contentious factor, and TSMC expected workers to comply with intense 12-hour shifts, something that labor unions vigorously opposed. Unions also complained about poor TSMC management, including safety violations and injuries.

Until America develops a supremely qualified workforce to take on the new jobs, Trump's grand vision of returning manufacturing will face challenges. To be sure, many community colleges have already stepped up training high school youth in advanced manufacturing techniques, opening up a middle-class lifestyle to 18-year-olds who will never have to go to college or take on a dollar of student debt. The Wall Street Journal recently ran a story about how a Philadelphia-area high school is preparing juniors with $70,000-a-year job offers by training them in shop classes.

However, establishing a large, skilled workforce takes time. In the meantime, worker mobility is crucial. Foreign workers would have to relocate to the United States to fulfill those in-demand roles for the time being. Congress established the H-1B visa, designed to bring the "best and brightest" for short periods. However, it has been severely abused for nearly 25 years by Indian tech companies intent on outsourcing work back to India and international students wishing to immigrate to America and taking those jobs away from native American youth who could have been trained. In either case, Trump's MAGA vision fails.

President Trump has remained silent on the issue of worker mobility, expressing support for importing labor but vacillating on the details. His key confidant, Elon Musk, and the titans of the tech industry heavily favor the H-1B route.

However, Stephen Bannon, the unofficial leader of the MAGA movement outside the White House and with a powerful megaphone because of his podcast, is extraordinarily critical of any worker mobility concessions that Trump may grant a nation as part of a trade agreement. On his War Room podcast this week, Bannon called out the "myth" that foreign H-1B workers are more skilled than Americans, labeling it a "scam" perpetuated by Wall Street and Silicon Valley.

President Trump is in an unenviable corner. If he doesn't address worker mobility to tackle the issue of an undertrained American workforce, he risks alienating his MAGA base for failing to usher in a successful manufacturing resurgence. If he grants more work visas to foreigners, he risks alienating his MAGA base by taking jobs away from voters and giving them to new arrivals.

TIPP Picks

Selected articles from tippinsights.com and more

1. Trump Can Still Lead Without A Third Term—Victor Davis Hanson, The Daily Signal

2. Pope Leo, Populism, And The American Economy—Josh Mercer and Steve Cortes, RealClearPolitics

3. Trump, Master Of Diplomacy, Doth Hold Back The Fires Of War—Editorial Board, TIPP Insights

4. How Wall Street Loopholes Funnel US Capital To Chinese Communist Party—Rob Bluey, The Daily Signal

5. What Will Trump Find In The Middle East This Week?—Ron Paul, Ron Paul Institute for Peace and Prosperity

6. Turkey: A Rogue US Ally’s Territorial Conquests—Ted Galen Carpenter, Ron Paul Institute for Peace and Prosperity

7. US House Approves MEGOBARI Act to Pursue In Georgia More Ukraine-style Intervention and Conflict With Russia—Adam Dick, Ron Paul Institute for Peace and Prosperity

8. The ‘N’ In SNAP Means Nutrition—Star Parker, The Daily Signal

9. House GOP Plans To Strip Billions From States That Give Illegal Migrants Free Healthcare—Floyd Buford, DCNF

10. Criminal Docs Blow Apart Media Narrative About Migrant In El Salvador Prison—Hudson Crozier, DCNF

11. DHS Ready To Slap Handcuffs On AOC If She Trespasses Or Assaults ICE Agents—Hailey Gomez, DCNF

12. ‘A Little Bit Problematic’: Brit Hume Breaks Down Why Qatar’s Gift Possibly More Toxic Than Trump Realizes—Mariane Angela, DCNF

13. Israel Left Off Trump’s First Foreign Itinerary—TIPP Staff, TIPP Insights

14. Deal To Free Last Living American Hostage Another Sign Of Strain In Trump-Netanyahu Relationship?—Bradley Devlin, The Daily Signal

15. Rejecting Calls For Medicaid Cuts, Hawley Castigates GOP’s ‘Wall Street Wing’—Jacob Adams, The Daily Signal

16. Crockett: Donors Want ‘Safest White Boy’ as 2028 Nominee—George Caldwell, The Daily Signal

17. Sanders And Tillis Top This Week’s Washington Head-Scratchers—Al Perrotta, The Daily Signal

18. The Judicial Appointment Train Is Leaving The Station—Thomas Jipping, The Daily Signal

19. Trump To Sign Executive Order To Slash Prescription Drug Prices—Keith Koffler, The Daily Signal

20. How Trump’s Drug Price Executive Order Will Affect Medicare—Elizabeth Troutman Mitchell, The Daily Signal

21. Trump Can Fix Major Manufacturing Issue No One’s Talking About—Mary Rooke, DCNF

22. Schumpeter On The Dangers Of The “Tax State”—Joseph Solis-Mullen, Mises Wire

23. Trump Meets Gulf Allies In Middle East Trip—TIPP Staff, TIPP Insights

24. UN Body Rules Russia Responsible For Downing Of MH17—TIPP Staff, TIPP Insights

25. ‘New Beginning:’ Syria Hails Trump Sanctions Move, Praises Saudi Role—TIPP Staff, TIPP Insights

26. Inflation Eases, Trump Targets 'Too Late Powell' Again—TIPP Staff, TIPP Insights

27. 'Most Destructive Force:' Trump Warns Iran And Extends One Last Offer—TIPP Staff, TIPP Insights

28. Trump Drops Syria Sanctions After Crown Prince Request—TIPP Staff, TIPP Insights

29. Harvard Loses $450M More In Federal Funding—TIPP Staff, TIPP Insights

30. Sam Altman Meets Saudi Crown Prince With Trump In Riyadh—TIPP Staff, TIPP Insights

31. U.S. And Saudi Arabia Ink $142 Billion Defense Deal—TIPP Staff, TIPP Insights

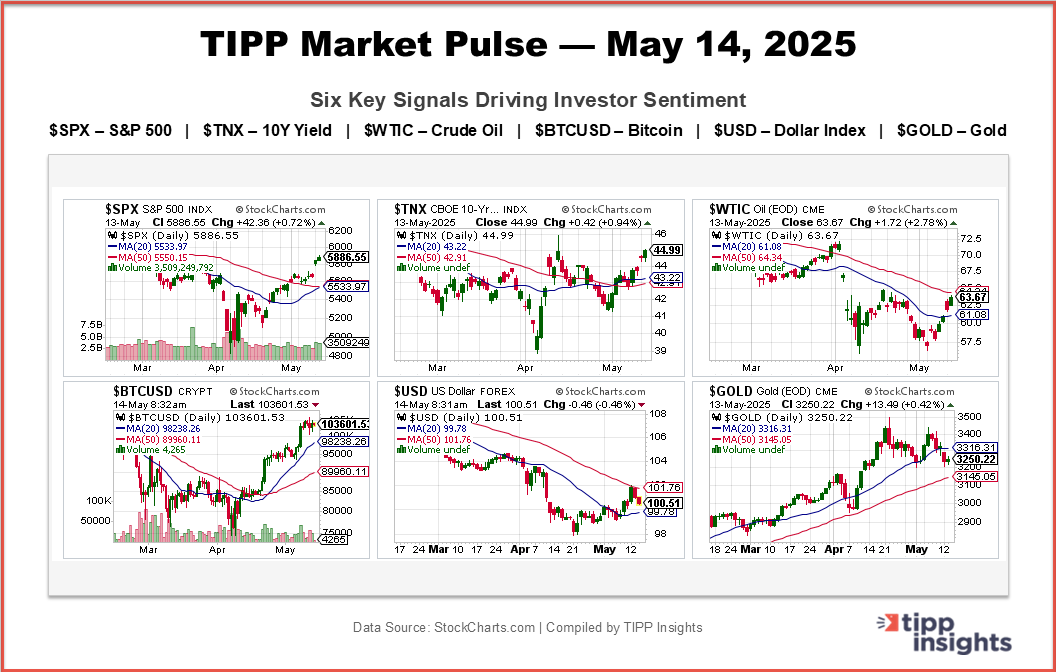

TIPP Market Brief – May 14, 2025

Your Morning Snapshot

📊 Market Snapshot

- S&P 500: 5,886.55 – ▲ 0.72%

- 10-Year Yield: 4.499% – ▲ 4 basis points

- Crude Oil (WTI): $63.67 – ▲ 2.78%

- Bitcoin (BTC): $103,505.45 ▼

- US Dollar Index (USD): 100.50 – ▲ 0.47%

- Gold: $3,250.22 – ▲ 0.42%

Bigger Charts: $SPX | $TNX | $WTIC | $BTCUSD | $USD | $GOLD

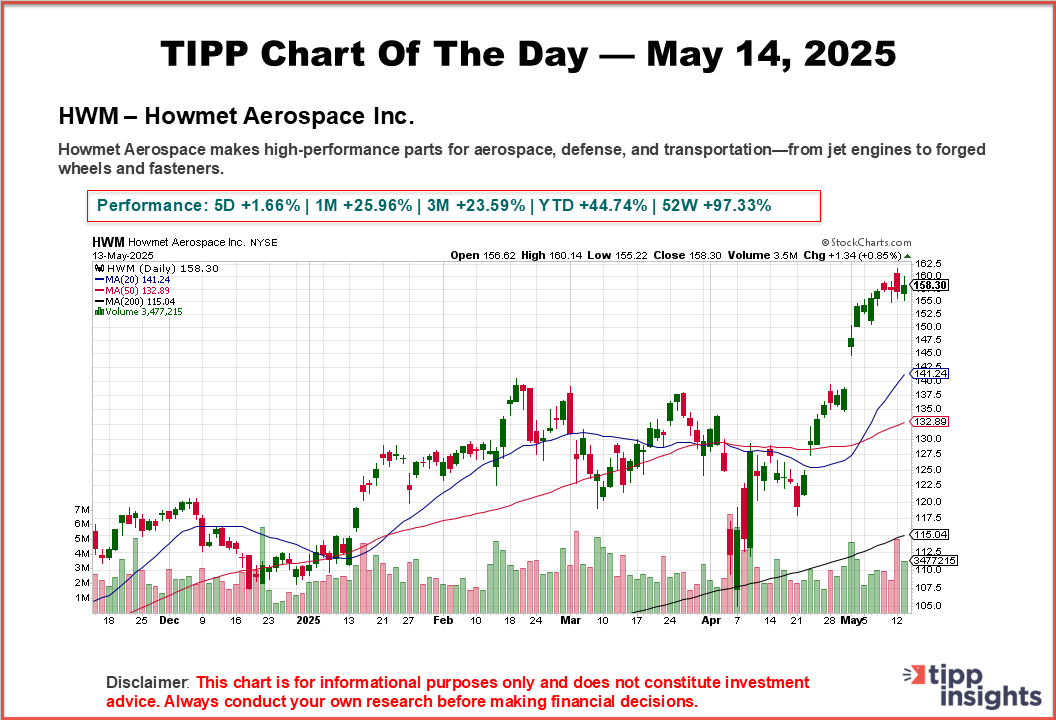

📈 Featured Stock

Our pick for today’s featured stock

📰 News & Headlines

What Makes Howmet (HWM) a Strong Momentum Stock: Buy Now?—Zacks Equity Research

Jim Cramer on Howmet Aerospace (HWM): "Another Amazing Quarter in the Aerospace Bull Market"—Ramish Cheema, Insider Monkey

⭐Recent Featured Stocks

Okta, Inc.(OKTA) (5/13)

Root, Inc.(ROOT) (5/12)

Sea Limited (SE) (5/9)

Philip Morris (PM) (5/8)

Comstock Resources (CRK) (5/7)

Spotify (SPOT) (5/6)

Kratos Defense & Security Solutions, Inc. (KTOS) (5/5)

Stride, Inc. (LRN). (5/2)

NetfliX (NFLX) (5/1)

Palantir (PLTR) (4/30)

More here

🧠 Macro Insight

U.S. futures are flat as investors wait for Cisco’s (CSCO) earnings and watch how trade news plays out. Cisco’s results will show if tariffs are hurting tech profits.

Reports say tariffs on small packages from China may drop to 30%, down from 120%, helping ease trade worries. Sony expects a big charge from U.S. tariffs but says it’s planning for different outcomes.

Oil prices are slightly down after rising U.S. stockpiles raised new concerns about demand.

📅 Key Events Today

- 10:30 AM ET – Crude Oil Inventories

Weekly update on U.S. oil stockpiles, offering insight into supply, demand, and price trends.