- The latest SBE Council Small Business Check Up survey reveals that business owners in the third quarter of 2023 are dealing with significant economic and business challenges.

- These challenges include inflationary pressures, high interest rates, and uncertainty.

- External factors like limited access to capital and workers are constraining small business growth and opportunity.

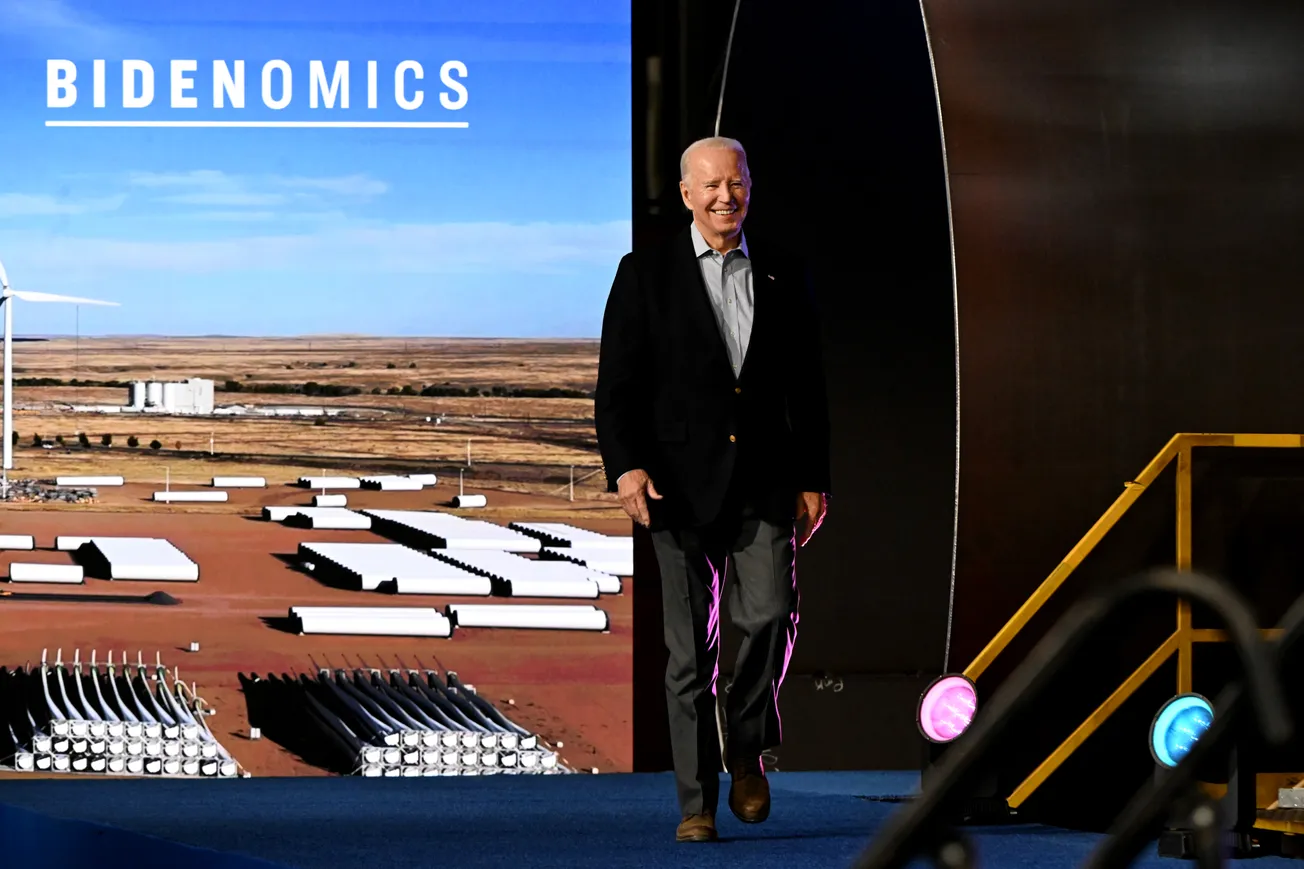

- Significant percentages of small business owners attribute these headwinds to President Biden's policies and express dissatisfaction with his leadership.

- Their perception that the economy will deteriorate for the remainder of 2023, and a pulling back on investment and hiring will have broader economic implications.

The latest SMALL BUSINESS CHECK UP SURVEY for the third quarter of 2023, carried out by TechnoMetrica from August 23-25, 2023 for the Small Business & Entrepreneurship Council’s (SBE Council), shed light on the volatile economic conditions and the tenacity of small business owners.

While the majority of small business owners view current business conditions as generally positive, inflationary pressures, higher interest rates, rising cost of inputs, and increased operating expenses are impeding growth and eating into their profits. Furthermore, these entrepreneurs expect the conditions to worsen in the next six to twelve months, putting additional pressure on their businesses.

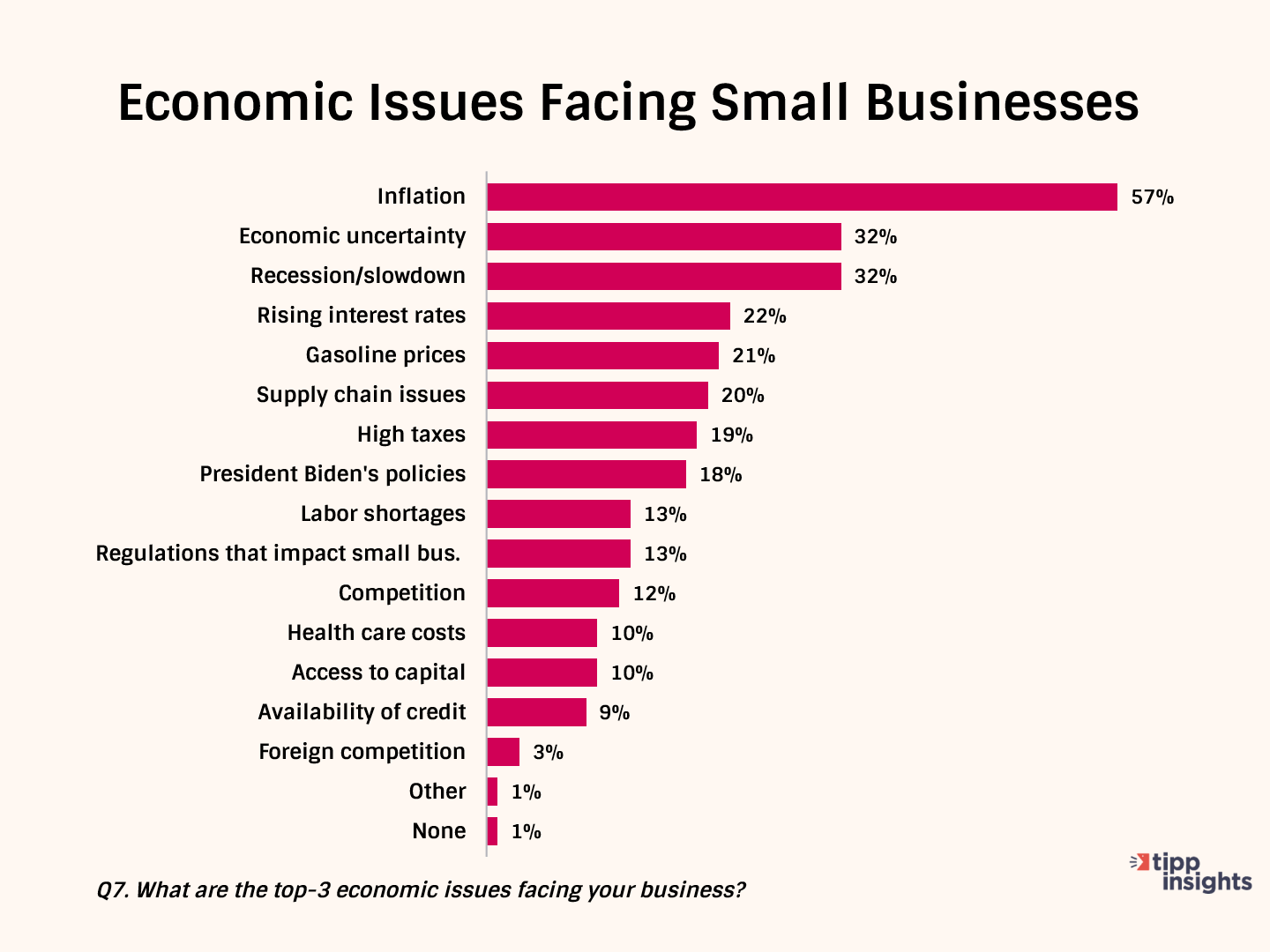

A significant percentage (52%) of Q3 Small Business Check Up Survey small business respondents reported that revenues have not kept pace with inflation. Small business owners rank inflation (57%), economic uncertainty (32%), recession/slowdown (32%), rising interest rates (22%), and high gas prices (21%) as their top five concerns.

The relentless squeeze of inflation persists for small business owners as they navigate the tiring balance of increasing prices in order to break even or stay profitable. A significant percentage of small business owners continue to report that their capital and human capital needs are not being met, which means they can’t access the primary inputs for generating needed revenues.

The survey also found that a majority (61%) believe economic conditions will deteriorate for the remainder of 2023. Given their downbeat outlook, the broader economy will no doubt be affected by the daunting challenges many small businesses are facing. With 89% of small business owners expressing concern about inflation and 86% worried about an economic slowdown or recession, there will be less risk-taking, innovation, and hiring overall, which will hurt local economies as well as the broader U.S. economy.

In areas where some small business owners want or need to spend in order to generate business revenue and growth, that activity is being constrained by external forces. According to the survey, 48% of small business owners report that labor shortages and limited access to skilled labor are hampering operating capacity.

Availability of credit is another matter restricting their firms: 49% say the lack of credit or access to capital are impeding business operations and growth. Two-thirds (62%) rate credit availability as fair or poor, while only 33% consider it excellent or good.

Not surprisingly, 59% of small business owners report that they are cutting back on spending. Travel, investments in equipment, updating technology, and new hiring top the list of areas with curtailed budgets.

The volatility in the economy is visible in customer behavior. In terms of sales, the results are mixed for small businesses: 35% have experienced decreased sales in 2023, 40% reported increased sales, and 23% reported steady sales. In terms of business profitability to date: 42% report decreased profitability, while 34% have experienced improved profitability.

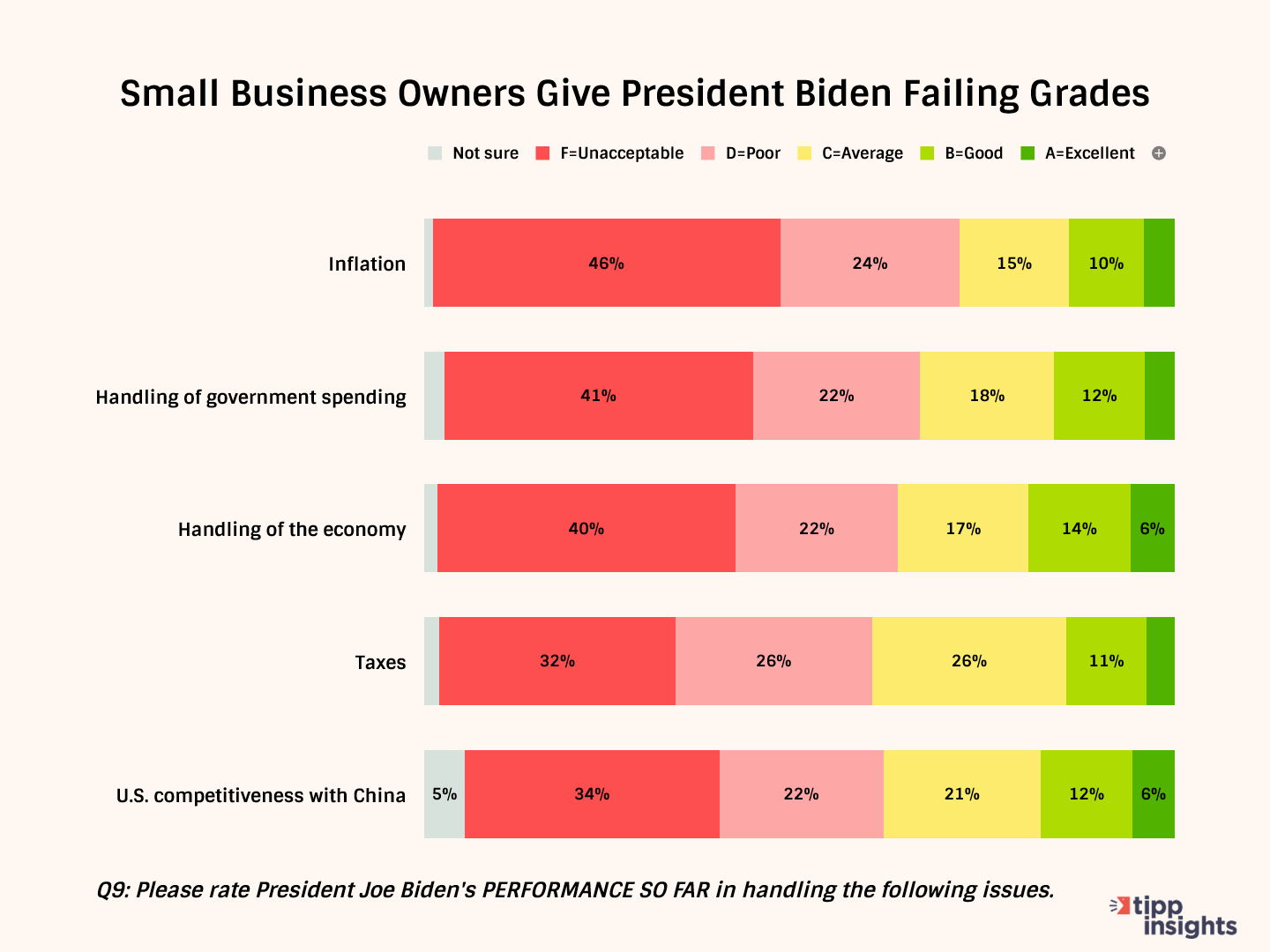

Many of the small business owners hold President Biden’s policies responsible for the current state of affairs. They award him poor or failing grades in crucial areas that affect the business environment and economy.

“Combating inflation” receives a failing grade from 70% of small business respondents. Management of government spending is similarly unfavorable, with 63% giving low grades. Over six in ten (62%) are dissatisfied with President Biden's handling of the economy, compared to 20% who rate him favorably. Two-thirds blame the Biden Administration for high gas prices.

None of the President’s policies receives a good grade. From capital access issues to high gas prices, small business friendliness, and more, the Biden Administration has a lot of work to do to gain the confidence of small business owners.

From the start of his Administration, the SBE Council has urged President Biden to continually and consistently listen to entrepreneurs and small business owners. Based on the policy choices and actions of his Administration, small business has largely been cut out of White House discussions on critical issues. The regulatory tidal wave, for example, and intrusive policies that are putting more burdens, red tape, and restrictions on entrepreneurs and small businesses are proof that the views and needs of small business owners are not being considered.

Karen Kerrigan is president & CEO of the Small Business & Entrepreneurship Council.

Please email editor-tippinsights@technometrica.com